value appeal property tax services

You should pay your property taxes directly to the county treasurers office where your property is located. Establishes the assessed value of your property by appraising the value of that property under applicable State laws.

Property Assessment Process Adams County Government

Important real estate and personal property tax dates for all 50 states.

. Can I appeal my property valuation. The taxpayer may appeal any property valuation in the county so long as the taxpayer owns property in the county. In most states an appeal notification consists of a letter stating your intentions see a sample property tax appeal letter below.

Your assessed value is as of January 1 st. It is important to note that not utilizing their services will not exempt a property from taxation. Our property tax professionals help you save no matter where you are.

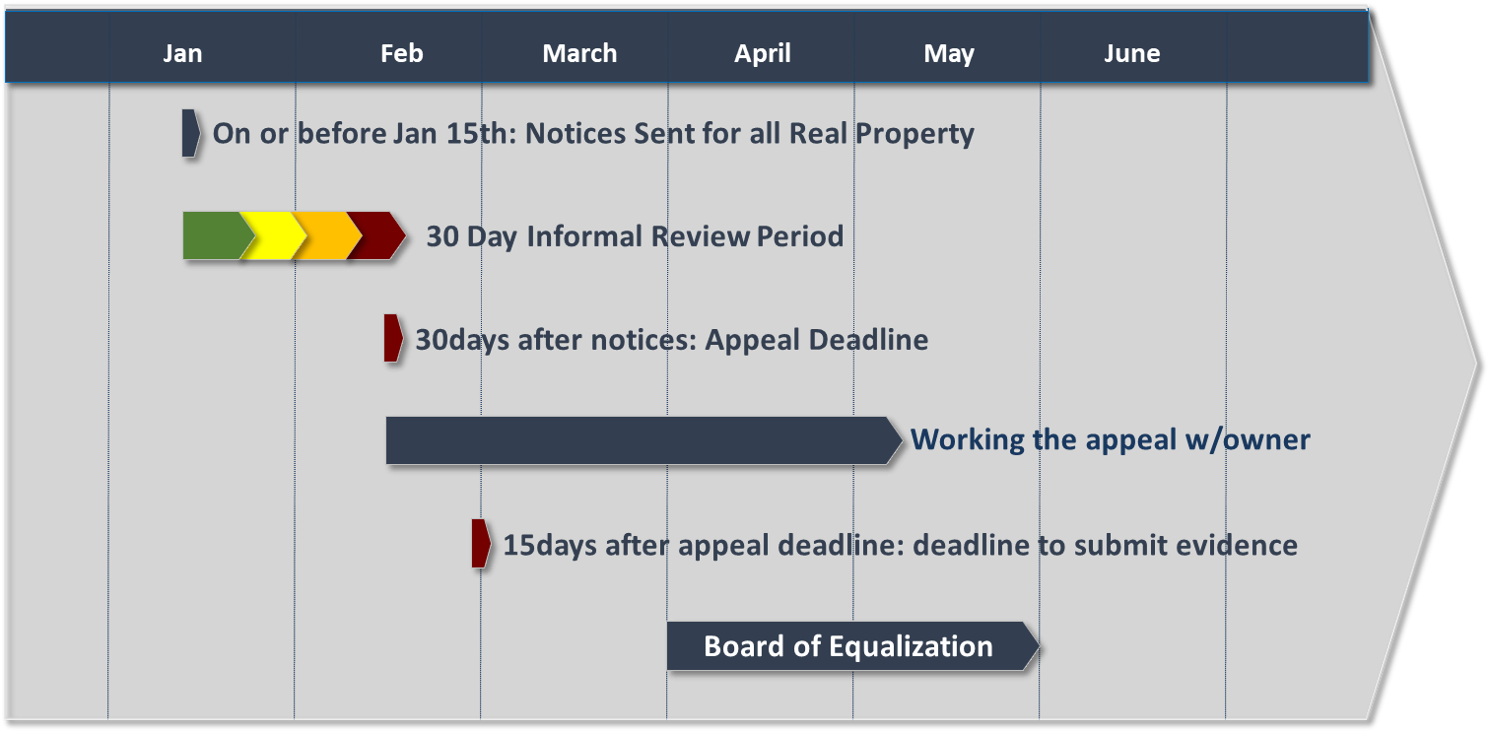

Appeal Deadline 25 Days after value notices issued. When going through the appeal process you the property owner are appealing the assessed value of your property not the tax bill. Our team can reduce your property taxes every year for residential commercial and BPP and provide you with property tax relief Read More.

May 16th of the year appealed. Paying your property tax. You pay your tax on the total value.

Appeal Real Property - Deadline. Adjusting your tax account. You may also contact the Property Appraisal office at 404 371-0841.

Properties are taxed according to their fair market value. Professionalism Quality Responsiveness Value Used another firm for years. Determine how much of their services need to be funded by property tax dollars.

We value land as though vacant. Property Tax Appeal Letters. The temporary value is determined by the lesser of your prior year final value OR 85 percent of the current year value unless there were capital improvements to the property in which case it will be 85 percent of the current year value.

If these budgets change from one year to the next then the property tax rate can change -- and so can your exemption savings. Learn more and save property taxes. Tax Bills Issued Nov 30.

RPT provides professional property tax assessment appeal representation. Then I moved and bought a new house. You can visit their website for more information regarding property appraisal in DeKalb County.

The deadline to appeal can be found on the Property Assessment Notice you received from MPAC. They NEVER got me a reduction in my property taxes. Most recent valuation notice only.

Understanding your tax bill and tips on keeping your property value as low as possible Read More. For additional information regarding the appeal process please. Wouldnt you know they got me a sizable reduction right away.

Any change in assessed value as a result of that appeal will. Subtracting the land value from the total value leaves any remaining value that the market recognizes as contributory to. The tax bills received by property owners from the counties will include both the fair market value and the assessed value of the property.

Appeal Motor Vehicle Value Deadline. Learn more about paying or appealing your property tax. The appeal process begins at the local level.

The Property Appraisal Department is responsible for the appraisal and assessment of property. Your 2019 assessment value will determine the amount of taxes you pay in 2020 the first half of your taxes will be due in April. In many cases the first step is to contact the tax office informally and seek to resolve the difference without filing a formal appeal.

Property Tax Appeal Services. Weve provided contact information for Washingtons 39 counties to assist you. Republic Property Tax RPT is a full-service property tax consulting company with expertise in real estate personal property cost segregation and the complex valuation issues associated with special-use properties.

Welcome to the Riverside County Property Tax Portal. 4168 Savings est. If you decide to appeal the valuation the first step in the property tax appeal process is to simply notify the assessing jurisdiction of your intentions.

Auditors office will start accepting property valuation appeals August 1 through September 15 2022. We are not associated with any government agency. Deadline for 4 discount.

These tax rates vary depending on the level of services provided and the total value of the countys tax base. The City can only adjust your property tax account after receiving notification of a decision from MPAC or the ARB for any change in. Property taxes are levied collected and spent locally to finance a major part of the services that units of local government provide to their residents.

Appeal Business Personal Property Value Deadline. The tax calculator showing your anticipated taxes for 2022 has been updated with the tax rates that. Notice of Value.

When to File an Appeal - Within 60 Days of the Mailing Date of your Official Property Value Notice The Department of Assessments will be mailing Official Property Value Notice 1 cards for the 2020 assessment year between May and November 2020. Where can I find information about the value of my property. Property tax minimization services for real and personal.

Total value is reflective of the market at a given point in time. Then switched to Lake County Appeal and they got me a sizable reduction the first time I used them. How When To Submit.

If you are appealing multiple vehicles please submit a separate form for each vehicle. Fair market value means the amount a knowledgeable buyer would pay for the property and a willing seller would accept for the property at an arms length bona fide sale OCGA. A month ago Positive.

Tax deeds for properties purchased at tax sale will be issued by the first part of July. For example the tax on a property appraised at 10000 will be ten times greater than a property valued at 1000. If the property is non-homesteaded and valued at over 2 million you may elect to be.

The real estate market is constantly changing. Specify whether you want to be billed at 85 or 100 of the assessed value while your appeal is being resolved If you do not specify an appeal method or billing percentage your appeal will be selected for Board of Equalization and 85. The Equalized Assessed Value is used to calculate property tax bills.

State your estimate of the value of your property as of January 1st for the year that you are appealing. The Montgomery County Online Property Tax Protest system allows you to perform functions to help on your property tax appeal. New values on properties are available from the Assessors office.

Over 1 year Due to Property Tax Solutions appeal Over Valuation A couple purchased a home for 300000 in an arms-length transaction but the Assessor estimated the market value at 360000 - a full 60000 above the actual price. The TAX RATE for each county and municipality is set by the mayor and the legislative body of the counties and municipalities based on the amount budgeted to fund services.

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Writing A Property Tax Assessment Appeal Letter W Examples

Writing A Property Tax Assessment Appeal Letter W Examples

Writing A Property Tax Assessment Appeal Letter W Examples

Contesting Your Property Value Los Angeles County Property Tax Portal

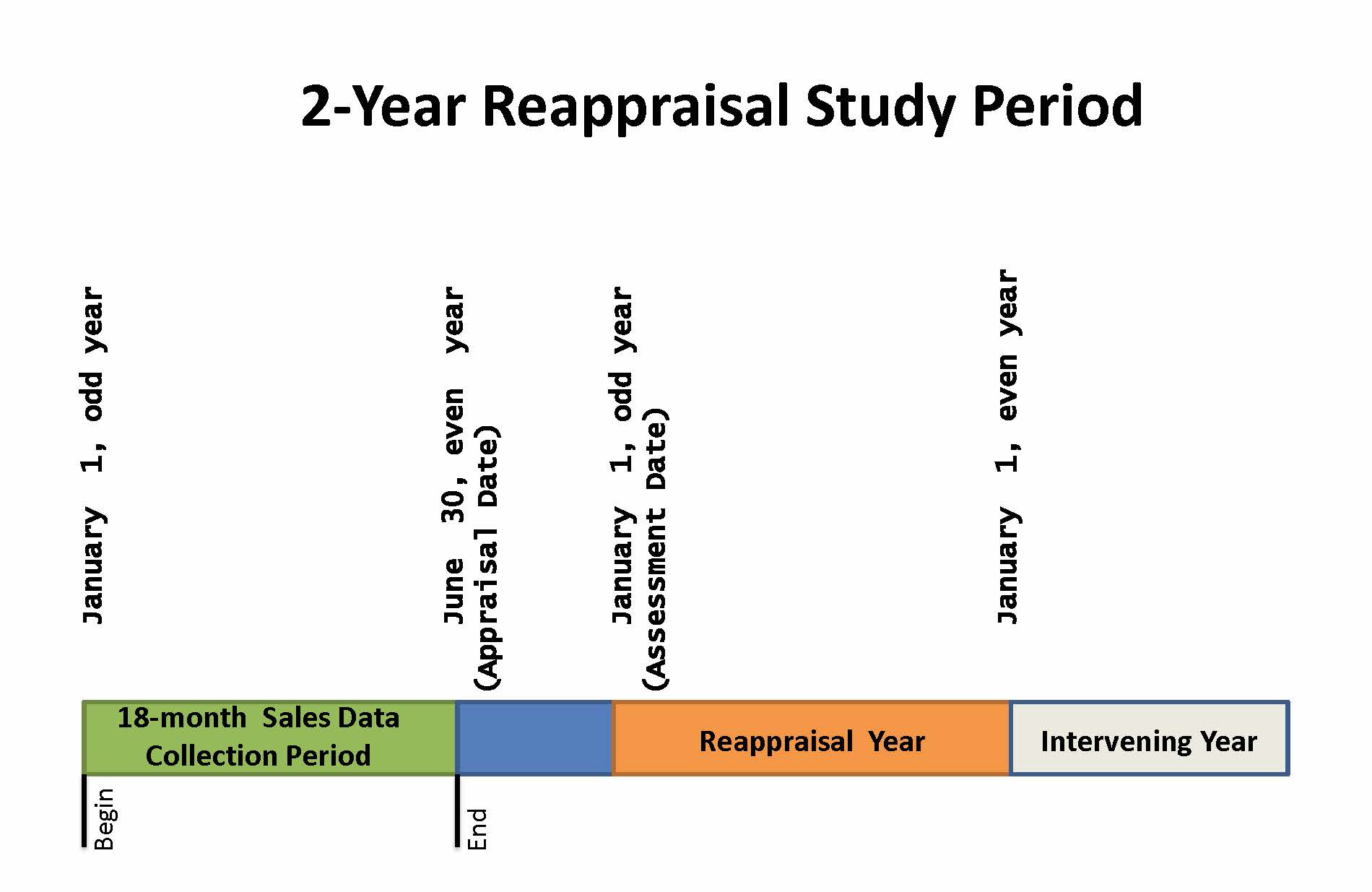

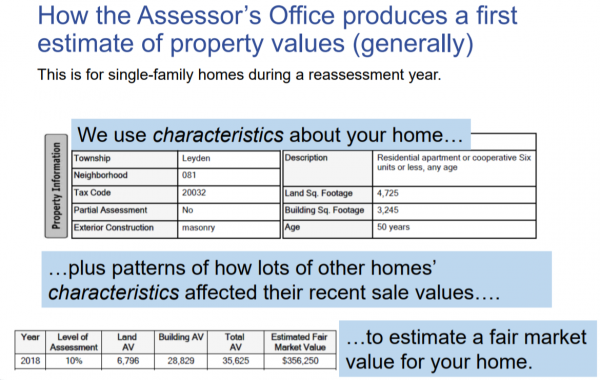

How Residential Property Is Valued Cook County Assessor S Office

Writing A Property Tax Assessment Appeal Letter W Examples

Timeline For Property Taxes Carver County Mn

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Property Tax Appeal Tips To Reduce Your Property Tax Bill

How Do I Faqs About Appealing Assessments

Property Tax Appeals When How Why To Submit Plus A Sample Letter

Writing A Property Tax Assessment Appeal Letter W Examples

Property Tax Appeals When How Why To Submit Plus A Sample Letter